谢谢关注愉悦资本。

本文来自美国Redpoint VC的合伙人Mahesh的博客。文章收集了各个渠道披露的Uber的收入和亏损数据,形成对收入规模和增长的预测,并和上市的互联网公司对比。简单讲,如果参照Facebook的待遇(这是互联网公司绝无仅有的待遇),10倍P/S,Uber最多值1250亿美金。如果6倍P/S,上一轮投资人基本上就不用想挣钱了。既然说了Uber,我用同样的框架在后面补充了几句对滴滴的估值看法,纯属探讨,不要骂街。

At a $68B valuation, Uber is worth more than GM, Ford, Honda, and most other auto makers (save for Toyota, Daimler, Volkswagen and BMW). In fact, Uber is also worth more than most large cap internet companies including titans such as Netflix ($50B), PayPal ($50B), Baidu ($58B), and eBay ($32B). To put things into perspective, the only US public internet companies worth MORE than Uber right now are Apple ($578B), Google ($525B), Microsoft ($462B), Amazon ($350B), Facebook ($350B), and Priceline (just barely at $71B).

按照Uber680亿美元的估值,Uber的价值超过了通用汽车、福特、本田和大多数其他汽车制造商(除了丰田、戴姆勒、大众和宝马)。事实上,Uber的价值也超过大多数大型互联网公司,包括Netflix(500亿美元),PayPal(500亿美元),百度(580亿美元)和eBay(320亿美元)等巨头。换个角度看,目前比Uber价值更高的美国上市互联网公司只有苹果(5780亿美元),谷歌(5250亿美元),微软(4620亿美元),亚马逊(3500亿美元),Facebook(3500亿美元) Priceline(刚刚710亿美元)。

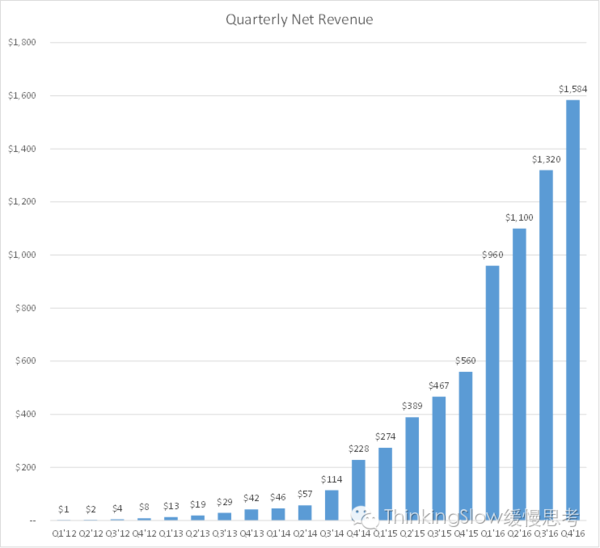

Uber is growing incredibly quickly, but losses are also growing. Using public information only, I've cobbled together Uber's revenue and net loss metrics that I found from various press leaks. Naturally, there are some inconsistencies and gaps in the data, and so I made my own estimates where necessary in order to get a sense for Uber's income statement. By understanding their P&L and growth trajectory, we can make some rough estimates for what a 2017 IPO could look like. Let's first look at Uber's quarterly net revenue.

Uber的增长速度令人难以置信,但亏损也同步增加。使用公开信息,我把Uber从各种新闻报道中提到的收入和净亏损指标拼凑在一起。不用说,数据存在一些不一致和差距,因此我在必要时进行了自己的估计,以便对Uber的损益表有一个概貌的了解。通过了解他们的损益和增长轨迹,我们可以对2017年IPO的情况进行一些粗略估计。让我们先看看Uber的季度净收入。

What a growth ramp! Keep in mind that Uber's net revenue is net of paying drivers and so actual GMV is roughly 5x these amounts (~20% net revenue margin). Most of Uber's 2012 and 2013 numbers were leaked, as well as some quarterly metrics for 2014-2016. Growth has always been strong, but there was a massive step function in 2014 and 2015, largely driven by international expansion. Most recently, Uber did $960M net revenue in Q1 2016 and then grew a "modest" 15% in Q2 2016 to $1.1B. These impressive net revenue figures, however, came at a steep cost.

增长曲线太惊人了!请记住,Uber的净收入是扣除了支付司机的收入,因此实际GMV大约是这些金额的5倍(约20%的净收入利润)。Uber2012年和2013年的大部分数字都有透露,2014-2016年的一些季度指标也有报道。增长一直很强劲,但在2014年和2015年有巨大的阶跃,主要是由于国际扩张推动。最近,Uber 2016年第一季度的净收入为9.6亿美元,2016年第二季度增长还可以,达到15%,收入为11亿美元。然而,这些令人印象深刻的净收入数字背后却是高昂的成本。

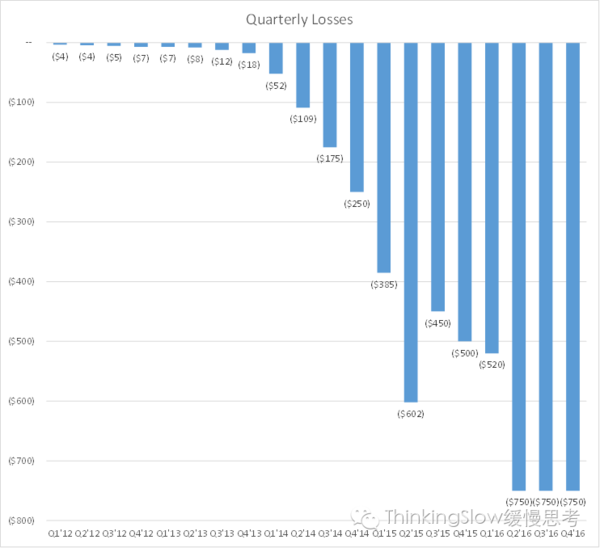

Data for net income (or net loss) is less reported and harder to make estimates for. While net revenue has been growing fairly consistently, losses can spike and narrow at the company's whim and largely depends on factors such as competition, market expansion, marketing spend, and so forth. Regardless, the general trend is captured above. Most recently, Uber lost $570M in Q1 2016 and $750M in Q2 2016. It's unclear whether losses will shrink or grow in the back half of 2016 so I kept them flat at $750M.

净利润(或净亏损)的数据报道较少,因此难以估计。虽然净收入增长相当稳定,净亏损的飙升和下降则取决于公司的的意愿,并且很大程度上取决于诸如竞争、市场扩张、营销支出等因素。无论如何,上面总体趋势是没问题的。最近,Uber在2016年第一季度亏损了5.7亿美元,2016年第二季度亏损了7.5亿美元。目前还不清楚2016年下半年的亏损会减少还是增长,所以我保持在7.5亿美元。

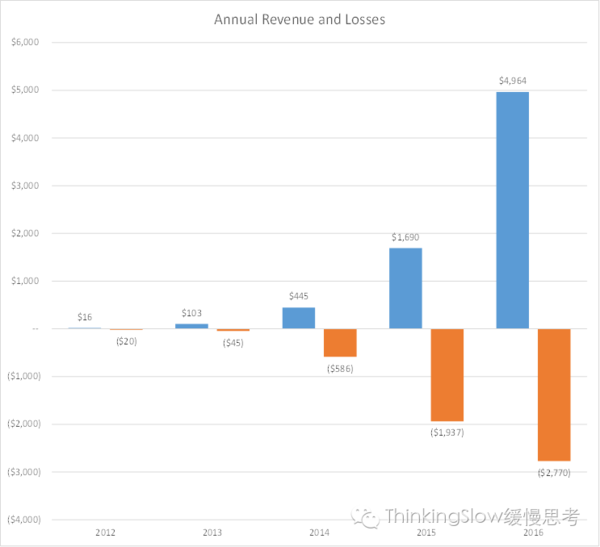

Looking at annualized numbers:

看看年化的数字:

Growth rates in 2013, 2014, 2015, and 2016 are roughly 537%, 332%, 280%, and 194%. Uber grew net revenue almost 4x in 2015 to $1.7B in revenue, but they lost $1.9B in net income. In 2016, they grew net revenue by 15% in Q2, and I forecasted an optimistic 20% growth rate for Q3 and Q4, so in aggregate I estimate 2016 net revenue to be roughly $5B, effectively tripling year over year. Making some basic estimates for net income, likely losses will be in the $2.5B-$3.0B range.

2013年、2014年、2015年和2016年的增长率分别为537%,332%,280%和194%。 Uber在2015年的净收入增长了近4倍,到达17亿美元,但净亏损高达19亿美元。在2016年,他们第二季度的净收入增长了15%,我乐观预测第三季度和第四季度20%的增长率,所以总体来说,我估计2016年的净收入大约是50亿美金,同比增长3倍。对净收入进行一些基本估计,可能的亏损将在25亿美元至30亿美元的范围内。

Looking at the annual growth trends, it seems like the company will grow net revenue by 100-150% in 2017. That would put net revenue in the $10-$12.5B range, and the losses against that are anyone's guess. The highest 2017 revenue multiple for a public internet company right now is about 9.0x, and that's for Facebook, a company that will generate almost $37B in revenue in 2017 with 63% EBITDA margins. Premium marketplace comps trade at 6.0-8.0x 2017 revenue and are generally quite profitable. Sure, Uber has much faster growth than these public comps, but Facebook is no slouch with 50% growth in 2016.

按照年度增长趋势,看起来公司2017年净收入增长100-150%。这将使净收入在100-125亿美元的范围内,而损失则很难估计。现在上市的互联网公司市值和2017年收入倍数比最高的是9.0倍,就是Facebook,它将在2017年创造近377亿美元的收入,EBITDA利润为63%。优秀的交易市场类的公司市值大约是6.0-8.0倍于2017年的收入,这些公司一般来说都利润可观。当然,Uber的增长速度远远高于这些公司的增长速度,但Facebook并不慢,2016年收入增长高达50%。

Let's say Uber does $12.5B net revenue in 2017. At a hefty 10x multiple, Uber would be worth $125B. At a more modest 6.0x multiple, they would still be worth $75B, a hair above their current private valuation.

如果假设,Uber在2017年的净收入为125亿美元。以10倍的倍数,Uber的价值为1250亿美元。如果是一个更适中的6.0倍的倍数,他们会值750亿美金,比现在私有市场的估值高那么一点点。

It's incredibly difficult to value companies growing as quickly as Uber. Their valuation will depend not only on top-line growth but also on how good of a business they have long-term. My guess is that there is enough hype around the company and that public market investors will eat up the growth story. However, that means Uber will have to keep up their torrid growth without any hiccups and convince investors that there is a path to profitability. The global ride sharing market is insanely competitive, riddled with regulatory challenges, and is inherently low margin (autonomous cars anyone?). Given the dynamics, I'm curious to hear how Uber pitches their story to the street and whether they are able to justify their frothy paper valuation.

对于像Uber这样增长迅速的公司而言,估值是件很困难的事情。他们的估值不仅取决于收入增长,也取决于他们业务长期的优势如何。我的猜测是,公司现在有足够的热度,公开市场的投资人会吃下这个增长的故事。然而,这意味着Uber必须保持他们的茁壮成长,没有任何打嗝,并说服投资者,有一条通向盈利的道路。全球共享出行市场竞争很疯狂,充斥着监管挑战,内在本质上是低利润率生意(除非汽车自动驾驶)。考虑到各种变数,我很想知道Uber如何把他们的故事带到华尔街,以及他们如何证明他们不乏泡沫的纸面估值。

译者:

按照这个分析框架,我试图讨论一下滴滴。再次声明:纯学术讨论,不要骂街:-)

10倍的P/S是很高的估值,Facebook可能因为网络效应独一无二的地位和高增长,享受了这个待遇。如果按照当前报道的滴滴估值为350亿美金左右,即使给予10倍P/S,意味着它2017年的净收入要达到35亿美金(约260亿人民币),并且还要保持100%以上的增长。根据虎嗅的报道(不一定正确),2016年收入预计102亿左右,同比增长67%,要实现2017年的目标,挑战不小。换一个角度,假设260亿收入全部来自专车收入,又假设客单价50元(参考出租车4美金客单价),平台一单收20%即10元,滴滴的专车日单要到达700多万单。

愉悦资本是新一代VC基金,由刘二海、李潇、戴汨创立,我们是创始人也是投资经理;愉悦资本,创始人和创始人对话。